Do you find yourself wondering whether you can use your FSA (Flexible Spending Account) for massage therapy? Well, you’ve come to the right place! At “Can I Use My FSA For Massage?” blog, we’re all about sharing our knowledge and passion for massage therapy with others who are just as enthusiastic. As massage therapists and enthusiasts ourselves, we love providing helpful insights and guidance on various topics related to both giving and receiving massages.

So, let’s address your burning question: Can you use your FSA for massage? The answer is a resounding YES! Massage therapy can often be considered a qualified medical expense under your FSA. It’s important to note that individual FSA plans may have different guidelines, so it’s always best to consult with your specific plan administrator for confirmation. Nonetheless, many FSA accounts allow you to use your funds for massage therapy if it is prescribed by a healthcare professional to treat a specific medical condition.

We hope this information has shed some light on the possibility of utilizing your FSA for massage therapy. Remember, we’re here to help you make the most of your FSA and provide valuable insights along the way. Stay tuned for more articles and tips on our blog!

What is FSA?

Definition of FSA

An FSA, or Flexible Spending Account, is a type of financial account that allows individuals to set aside pre-tax money to pay for eligible medical expenses. It is an employer-sponsored benefit and is commonly offered as part of a benefits package. The funds deposited into an FSA are deducted from the employee’s paycheck before taxes are applied, resulting in potential tax savings.

Purpose of FSA

The primary purpose of an FSA is to help individuals cover medical expenses that are not typically covered by health insurance. It provides a convenient way for individuals to budget and save for out-of-pocket healthcare costs. By contributing to an FSA, you can set aside money throughout the year, pre-tax, to be used for medical and healthcare expenses.

Eligible expenses under FSA

FSA funds can be used to cover a wide range of medical expenses. This includes doctor visits, prescription medications, dental and vision care, and even certain medical devices. Understanding which expenses are eligible is crucial to making the most of your FSA funds.

Understanding FSA Coverage for Massage

FSA and medical expenses

Massage therapy is a non-traditional medical treatment that can address various physical and mental health concerns. While FSA funds can typically be used for medical expenses, the coverage for massage therapy may vary depending on the nature of the treatment and the specific FSA plan.

Types of massage covered under FSA

FSA funds can potentially be used for massages that are deemed medically necessary. This typically includes massages that are prescribed by a healthcare professional as part of a treatment plan for a specific condition or ailment. Some examples of conditions that may warrant massage therapy as a treatment include chronic pain, muscle tension, stress-related disorders, and certain injuries or post-operative rehabilitation.

Limitations and restrictions

It is important to note that not all massages will be eligible for reimbursement under an FSA. Massages that are purely for relaxation or general wellness purposes may not be covered. To ensure eligibility, it is essential to consult the specific guidelines of your FSA plan and seek clarification from your FSA provider regarding the coverage for massage therapy.

This image is property of ballaura.com.

Qualified Massage Therapists

Certified massage therapists

When seeking massage therapy as a medical treatment, it is crucial to choose a qualified massage therapist who is certified and licensed. Certification ensures that the therapist has undergone specific training and has met the necessary requirements to practice massage therapy safely and effectively.

State regulations and licensing

Massage therapy regulations and licensing requirements vary from state to state. It is important to ensure that the massage therapist you choose is licensed in the state where the treatment will take place. By selecting a licensed therapist, you can have greater confidence in their skills, professionalism, and adherence to ethical standards.

Choosing a qualified therapist

To find a qualified massage therapist, you can start by asking for recommendations from your healthcare provider, friends, or family members who have had positive experiences. It is also beneficial to research and read reviews or testimonials to gauge the quality and effectiveness of a therapist’s services. When contacting a therapist, don’t hesitate to ask about their training, experience, and areas of expertise to determine if they are the right fit for your specific needs.

Prescription Requirement

Necessity of a prescription

In most cases, FSA reimbursement for massage therapy will require a prescription or recommendation from a qualified healthcare professional. This prescription serves as proof that the massage therapy is medically necessary for the treatment of a specific condition or ailment. Without a prescription, it is unlikely that FSA funds can be used for massage therapy expenses.

Conditions requiring massage as a treatment

Massage therapy can be beneficial for various medical conditions, including but not limited to chronic pain, musculoskeletal disorders, sports injuries, fibromyalgia, and stress-related conditions. However, it is important to consult with your healthcare provider to determine if massage therapy is an appropriate treatment for your specific condition. They can assess your medical history, symptoms, and overall health to determine the suitability of massage therapy as part of your treatment plan.

Role of healthcare provider

Your healthcare provider plays a crucial role in determining the necessity of massage therapy as a treatment. They can assess your condition, make a diagnosis, and provide a prescription if they believe massage therapy would be beneficial in managing your symptoms or aiding in your recovery. It is important to communicate openly with your healthcare provider about your desire to use FSA funds for massage therapy and discuss the potential benefits and risks.

This image is property of static.wixstatic.com.

Procedures to Use FSA for Massage

Consulting with FSA provider

Before using your FSA funds for massage therapy, it is advisable to consult with your FSA provider to understand the specific requirements and guidelines. They can provide you with the necessary forms and information needed to submit a reimbursement request. It is important to keep in mind that each FSA plan may have different rules and limitations, so it is crucial to familiarize yourself with the details of your particular plan.

Submitting claims

Once you have received massage therapy and obtained the necessary documentation, you can submit a claim for reimbursement. This typically involves completing a reimbursement form provided by your FSA provider and attaching the required supporting documentation. The documentation may include the healthcare provider’s prescription, itemized receipts, and any additional information requested by your FSA provider.

Documentation and record-keeping

To ensure a smooth reimbursement process, it is essential to maintain accurate records and documentation related to your massage therapy expenses. This includes retaining copies of prescriptions, receipts, and any communication with your healthcare provider and FSA provider. Good record-keeping will not only facilitate the reimbursement process but also serve as a reference for any potential audits or inquiries.

Frequently Asked Questions

Are all massages eligible expenses under FSA?

No, not all massages are eligible for reimbursement under an FSA. Only massages that are deemed medically necessary and prescribed by a qualified healthcare professional for the treatment of a specific condition may qualify for reimbursement.

Can I use FSA for massage to simply relax and de-stress?

In general, massages for relaxation and general wellness purposes are not eligible for FSA reimbursement. The primary focus of FSA funds is to cover medically necessary expenses rather than recreational or purely discretionary treatments.

What proof is required for FSA reimbursement?

Typically, a prescription or recommendation from a qualified healthcare professional is required as proof of medical necessity for FSA reimbursement. In addition, itemized receipts and any other documentation requested by your FSA provider may be required to support the claim.

Can FSA be used for at-home massage devices?

While FSA coverage for at-home massage devices may vary depending on the specific FSA plan, in many cases, they are eligible for reimbursement if they are prescribed by a healthcare professional as part of a treatment plan.

What other alternatives are available for FSA funds?

If massage therapy is not covered under your FSA plan or if you prefer alternative treatments, there are other eligible expenses that you can use your FSA funds for. These may include doctor visits, prescription medications, dental and vision care, over-the-counter medical supplies, and certain medical devices.

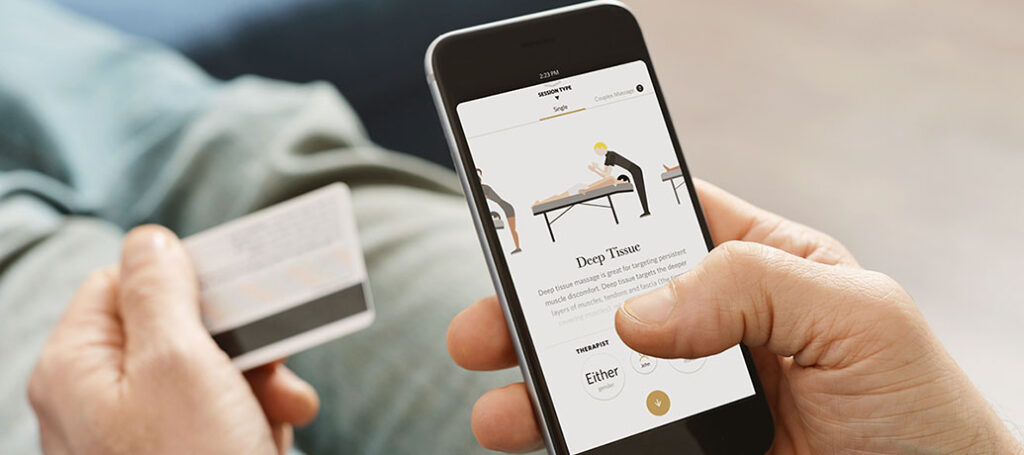

This image is property of www.zeel.com.

Conclusion

Using FSA funds for massage therapy can provide individuals with a convenient way to manage and budget for their healthcare expenses. By understanding the guidelines, limitations, and requirements set forth by their FSA plan, individuals can make informed decisions regarding the use of FSA funds for massage therapy. Consulting with qualified healthcare professionals, choosing licensed massage therapists, and maintaining accurate documentation are essential steps to maximize FSA coverage for massage therapy expenses.