Are you wondering if you can use your Health Savings Account (HSA) for purchasing tampons? In this article, we’ll explore the eligibility of tampons as a qualified medical expense that can be covered by your HSA. We’ll also discuss the regulations and guidelines surrounding the use of HSA funds for feminine hygiene products. By the end of this article, you’ll have a better understanding of whether or not you can utilize your HSA for purchasing tampons.

Can You Use HSA For Tampons?

As a healthcare consumer, you may be aware of the benefits of having a Health Savings Account (HSA). It offers a tax-advantaged way to save for medical expenses and can be an effective tool in managing healthcare costs. But can you use your HSA funds to purchase feminine hygiene products like tampons? Let’s delve into this question and explore the options available.

What is an HSA?

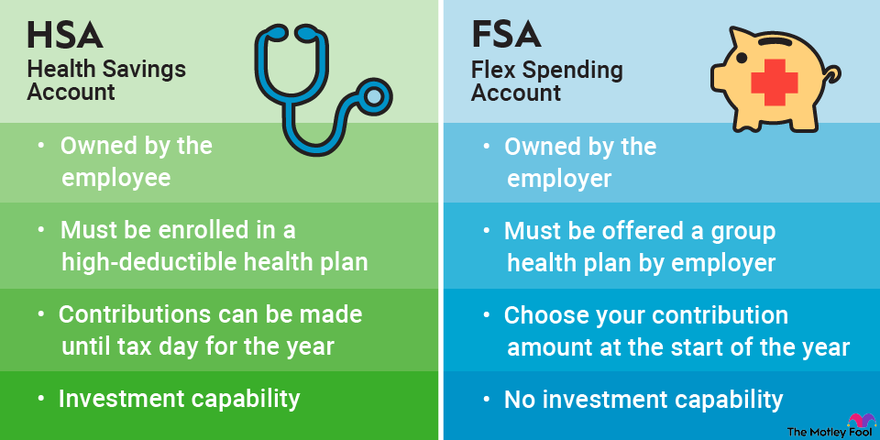

Before we dive into the specifics of whether you can use your HSA funds for tampons, let’s first understand what an HSA is. A Health Savings Account is a tax-advantaged savings account that allows individuals with high-deductible health plans to save money for medical expenses. Contributions to these accounts are made on a pre-tax basis, and any funds not used for medical expenses can be rolled over year after year, earning interest or investment gains.

Opening an HSA requires the individual to be enrolled in a high-deductible health plan. These plans typically have lower monthly premiums but require the individual to pay more out-of-pocket for medical expenses until reaching the deductible. This makes an HSA an attractive option for managing these costs.

Benefits of Having an HSA

There are several key benefits to having an HSA. Firstly, contributions to an HSA are tax-deductible, allowing you to reduce your taxable income. Secondly, the funds in your HSA can be invested, potentially growing over time and creating a valuable long-term savings tool. Furthermore, any withdrawals made for qualified medical expenses are tax-free, providing an additional savings opportunity.

What Items Can Be Purchased with HSA Funds?

When it comes to purchasing items with HSA funds, it is important to understand what expenses qualify. The Internal Revenue Service (IRS) provides guidelines on which medical expenses are eligible for reimbursement from your HSA.

Medical Expenses Covered by HSA

Generally, qualified medical expenses include a wide range of healthcare services, treatments, and products. These can include doctor visits, hospital stays, prescription medications, dental and vision care, and even certain mental health services. However, the IRS does not specifically list tampons or other feminine hygiene products as eligible medical expenses.

Over-the-Counter Items Eligible for HSA Reimbursement

In recent years, there have been changes to HSA regulations that allow for the reimbursement of certain over-the-counter (OTC) items. However, tampons and other feminine hygiene products are not currently included in this list. While some OTC medications and products, such as pain relievers or bandages, can be purchased with HSA funds, tampons do not fall into this category.

Prescription Medications Allowed under HSA

Prescription medications, on the other hand, are generally eligible for reimbursement from your HSA. If your doctor prescribes a medication for a specific medical condition or treatment, you can typically use your HSA funds to cover the cost. However, tampons are not considered prescription medications, and therefore, are not eligible for HSA reimbursement.

Feminine Hygiene Products and HSAs

Given that tampons and other feminine hygiene products are not considered eligible medical expenses by the IRS, you cannot use your HSA funds to purchase them. This raises questions about the fairness and accessibility of feminine hygiene products for women who rely on HSAs for their healthcare expenses.

Overview of Feminine Hygiene Products

Feminine hygiene products are essential items that women need on a regular basis. Tampons, pads, and menstrual cups are all necessary for managing menstrual bleeding and maintaining personal hygiene. However, the cost of these items can add up, especially for individuals on a tight budget.

Are Tampons Considered Medical Expenses?

While tampons are essential for managing menstrual bleeding, they are not considered medical expenses in the eyes of the IRS. Unfortunately, this means that HSA funds cannot be used to purchase tampons. This exclusion has sparked discussions about the unfairness of taxing feminine hygiene products as non-essential items.

Discussion on the Tax-Free Status of Tampons

Advocates for menstrual equity argue that feminine hygiene products, including tampons, should be considered tax-free medical necessities. They argue that these items are essential for the health and well-being of women and should, therefore, be treated as such.

Legislation and HSA Eligibility

The issue of HSA eligibility for tampons has gained attention in recent years, leading to discussions and proposed legislation on the matter. Let’s explore the current laws surrounding HSA eligibility and the potential for change.

Current Laws Surrounding HSA Eligibility

Under current law, tampons and other feminine hygiene products are not eligible expenses for HSA reimbursement. This omission has raised concerns regarding the fairness and accessibility of these products for women who rely on HSAs.

Discussion on Recent Changes to HSA Regulations

In recent years, there have been efforts to expand HSA eligibility for certain products and services. For example, the CARES Act, passed in response to the COVID-19 pandemic, temporarily allowed for the reimbursement of menstrual care products with HSA funds. However, this provision was limited to a specific timeframe and has since expired.

Proposed Legislation for HSA Coverage of Feminine Hygiene Products

Advocacy groups and lawmakers have recognized the need for HSA coverage of feminine hygiene products and have proposed legislation to address this issue. The Menstrual Equity for All Act and the HEROES Act are examples of bills that aim to make tampons and other feminine hygiene products eligible for HSA reimbursement.

This image is property of images.ctfassets.net.

Alternatives to Using HSA for Tampons

While tampons may not be currently eligible for HSA reimbursement, there are alternative options for those seeking assistance with the cost of feminine hygiene products.

Government Programs Providing Access to Free or Low-Cost Feminine Hygiene Products

Several government programs exist that provide access to free or low-cost feminine hygiene products. These include initiatives such as Medicaid, which covers medical expenses for individuals and families with low incomes, and WIC, which offers assistance to low-income pregnant women and families with young children.

Charitable Organizations Supporting Menstrual Hygiene

Many charitable organizations are dedicated to supporting menstrual hygiene and addressing the needs of individuals who cannot afford feminine hygiene products. These organizations provide products and resources to those in need, ensuring that everyone has access to these essential items.

Eco-Friendly and Cost-Effective Menstrual Product Options

In recent years, there has been a growing interest in eco-friendly and cost-effective menstrual product options. Menstrual cups and reusable cloth pads are gaining popularity as sustainable alternatives to traditional disposable products. While these options require an upfront investment, they can save money in the long run and reduce waste.

How to Check HSA Eligibility for Tampons

If you have any doubts about whether tampons or other feminine hygiene products are eligible for HSA reimbursement, there are steps you can take to get clarification.

Contacting HSA Provider for Clarification

The best way to determine HSA eligibility for tampons is to contact your HSA provider directly. They will be able to provide you with up-to-date information on what expenses qualify for reimbursement from your account.

Understanding IRS Guidelines on Eligible Expenses

While tampons may not currently meet the IRS criteria for eligible expenses, it is always a good idea to familiarize yourself with the guidelines. This will help you make informed decisions about your healthcare spending and take advantage of any available savings opportunities.

Seeking Guidance from Healthcare Professionals

If you have specific medical needs related to your menstrual cycle, it may be helpful to consult with healthcare professionals who can provide guidance on available treatment options. They may be able to recommend alternative products or treatments that are eligible for HSA reimbursement.

This image is property of hips.hearstapps.com.

Advocacy for HSA Coverage of Tampons

Efforts are underway to promote menstrual equity and advocate for HSA coverage of tampons. Let’s explore the current efforts being made and the importance of accessible feminine hygiene products.

Current Efforts to Include Tampons in HSA Coverage

Advocacy groups and lawmakers are actively working to include tampons and other feminine hygiene products in HSA coverage. These efforts aim to address the gender-specific healthcare needs of women and promote equality in healthcare.

Promoting Menstrual Equity and the Importance of Accessible Feminine Hygiene Products

Menstrual equity is a term used to describe the importance of ensuring that all individuals have access to affordable and safe feminine hygiene products. Lack of access can have serious health consequences and perpetuates societal stigma around menstruation. Advocates argue that menstrual equity is a fundamental aspect of reproductive health and gender equality.

Involvement of Advocacy Groups and Lawmakers

Several advocacy groups, such as Period Equity and The Menstrual Equity Coalition, are actively working to raise awareness about the need for HSA coverage of tampons. They collaborate with lawmakers to propose legislation that addresses this issue and seek to create change at the policy level.

Common Misconceptions about HSA Coverage

There are common misconceptions about HSA-eligible expenses and the coverage of tampons. Let’s address some of these misconceptions and clarify the facts.

Debunking Myths about HSA-Eligible Expenses

One common myth is that all healthcare expenses are automatically eligible for HSA reimbursement. In reality, the IRS has specific guidelines on eligible expenses, and not all healthcare costs qualify. Understanding these guidelines is essential for maximizing the benefits of your HSA.

Clarifying Misconceptions about Tampons and Medical Necessity

Another misconception is that tampons are considered non-essential items and therefore not eligible for HSA reimbursement. However, advocates argue that tampons are a necessary part of basic healthcare for women and should be treated as such.

Addressing Concerns Regarding HSA Funds Usage

Some individuals may have concerns about the appropriate use of HSA funds, particularly regarding non-traditional healthcare expenses. It is important to remember that an HSA is a personal healthcare savings account, and individuals have the freedom to use their funds for eligible expenses that meet their specific healthcare needs.

This image is property of cf-images.us-east-1.prod.boltdns.net.

Personal Finance Tips for Managing Menstrual Expenses

Managing menstrual expenses can be challenging for individuals on a tight budget. Here are some personal finance tips to help you navigate this aspect of your healthcare costs.

Budgeting for Feminine Hygiene Products

Including feminine hygiene products in your monthly budget can help you better manage your expenses. By setting aside a specific amount each month, you can ensure that you have the necessary funds available when needed.

Maximizing Savings with HSA and Tax Deductions

While tampons may not be eligible for HSA reimbursement, you can still maximize your savings by taking advantage of other eligible expenses. Additionally, if you itemize your deductions on your tax return, you may be able to deduct medical expenses that exceed a certain threshold.

Exploring Cost-Saving Strategies

Exploring cost-saving strategies can help minimize the impact of menstrual expenses on your budget. Options such as reusable menstrual products or purchasing in bulk can provide long-term savings. Additionally, keeping an eye out for sales, coupons, and discounts can help reduce costs.

Conclusion

While the current regulations regarding HSA eligibility for tampons may seem unfair, efforts are underway to address this issue and promote menstrual equity. Advocacy groups, lawmakers, and individuals are working together to bring attention to the importance of accessible feminine hygiene products and ensure that all women have affordable options. In the meantime, exploring alternative ways to manage menstrual expenses and maximizing HSA savings can help alleviate some of the financial burden. Remember, your healthcare is personal, and understanding your options is key to making informed decisions about your well-being.

This image is property of images.ctfassets.net.