Have you ever wondered if you can use your HSA (Health Savings Account) for a massage? In this article, we will explore this topic and provide you with all the information you need. We are a blog run by massage therapists and enthusiasts who love to share our insights and help fellow massage lovers. So, stay tuned to learn more about using your HSA for massage!

Can You Use HSA For Massage?

As a massage enthusiast, you may be wondering whether you can use your Health Savings Account (HSA) to cover the cost of your favorite massages. HSA is a tax-advantaged savings account that allows individuals to save money for qualified medical expenses. In this article, we will explore the ins and outs of using HSA for massage therapy, including the definition of HSA, how it works, and the benefits it provides. We will also dive into the eligibility for HSA, tax advantages, and limitations on using HSA for massage therapy. Finally, we will discuss alternative options for coverage and provide some tips and considerations to take into account.

This image is property of nwmassagetherapy.com.

What is HSA?

Definition of HSA

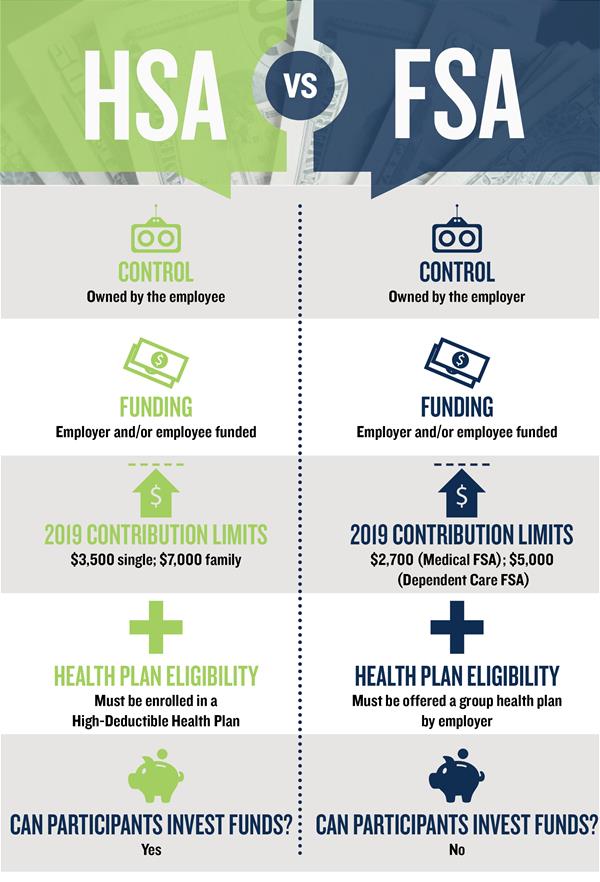

A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals to set aside pre-tax dollars to pay for qualified medical expenses. It is available to individuals who have a high-deductible health plan (HDHP). The funds deposited into the HSA can be invested and grow tax-free, and withdrawals are tax-free if used for qualified medical expenses.

How HSA Works

An HSA works similar to a personal savings account. Individuals can contribute funds to their HSA through payroll deductions or direct contributions. These contributions are tax-deductible, meaning they reduce your taxable income. The maximum contribution limits for 2021 are $3,600 for individuals and $7,200 for families, with an additional $1,000 catch-up contribution for individuals aged 55 or older.

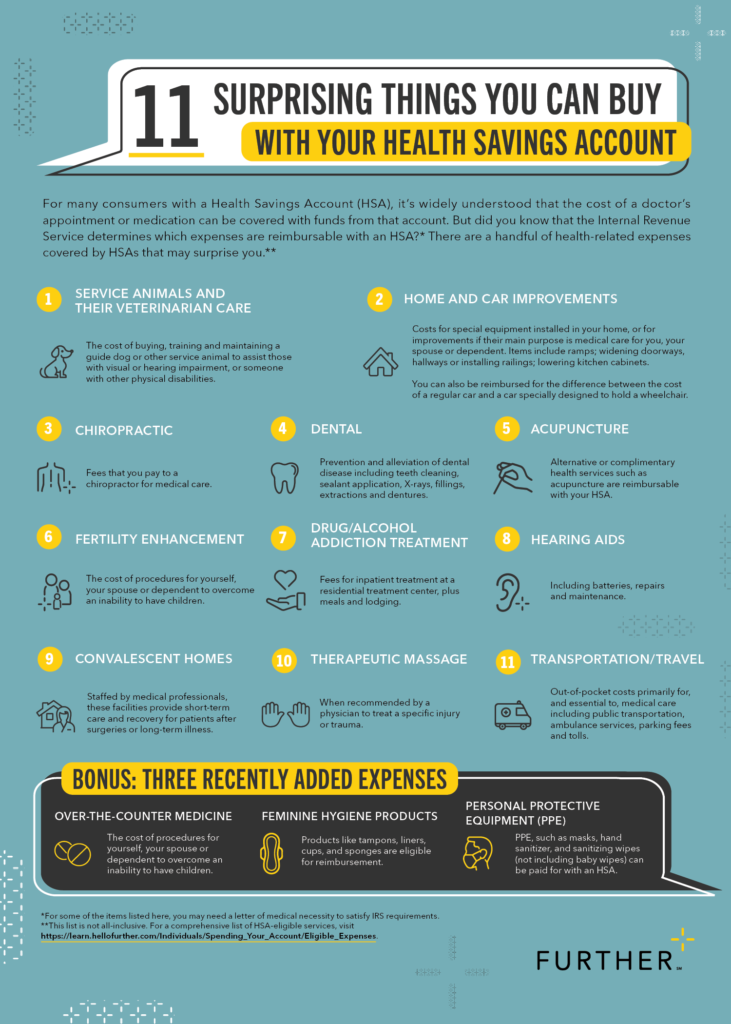

The funds in the HSA can be used to pay for qualified medical expenses, which include a wide range of medical services, treatments, and supplies. Expenses such as doctor visits, prescription medications, and medical equipment are commonly covered by an HSA. But what about massage therapy? Can it be considered a qualified medical expense?

Understanding Massage Therapy

Definition and Types of Massage Therapy

Massage therapy involves the manipulation of soft tissues in the body to promote relaxation, reduce stress, alleviate pain, and improve overall well-being. There are various types of massage therapy, including Swedish massage, deep tissue massage, sports massage, and hot stone massage. Each type has its own techniques and benefits.

Benefits of Massage Therapy

Massage therapy offers numerous benefits for both physical and mental well-being. It can help relieve muscle tension, reduce anxiety and depression, improve sleep quality, and enhance circulation. Many people turn to massage therapy as a complementary treatment for various conditions, such as chronic pain, sports injuries, and migraines.

Medical vs. Non-Medical Massage Therapy

It is important to distinguish between medical and non-medical massage therapy. Medical massage therapy is performed by a licensed healthcare professional, such as a physical therapist or chiropractor, as part of a treatment plan for a specific medical condition. Non-medical massage therapy, on the other hand, is typically provided by licensed massage therapists in a spa or wellness setting, primarily for relaxation and general well-being.

Can Massage Therapy be Considered a Qualified Medical Expense?

Definition of Qualified Medical Expenses

Qualified medical expenses are defined by the Internal Revenue Service (IRS) as expenses incurred for the diagnosis, treatment, or prevention of disease, as well as for the purpose of affecting any structure or function of the body. These expenses must be primarily for medical care and not for general health improvement or personal use.

IRS Guidelines on Qualified Medical Expenses

The IRS provides guidelines on what expenses are considered qualified medical expenses. While the list is not exhaustive, it includes common medical services and treatments, such as doctor visits, hospital stays, prescription medications, and medical equipment. However, the IRS does not specifically mention massage therapy as a qualified medical expense.

Is Massage Therapy Specifically Mentioned as a Qualified Medical Expense?

Massage therapy is not specifically mentioned as a qualified medical expense in the IRS guidelines. However, it doesn’t mean that massage therapy cannot be considered a qualified medical expense in certain circumstances. To determine whether massage therapy can be covered by an HSA, it is important to understand the role of Health Savings Accounts and the specific eligibility criteria.

The Role of Health Savings Accounts (HSA)

What is an HSA?

As mentioned earlier, an HSA is a tax-advantaged savings account that allows individuals to save money for qualified medical expenses. It is available to individuals who have a high-deductible health plan (HDHP), which is a health insurance plan with a higher deductible and lower monthly premiums compared to traditional health plans. The funds in the HSA can be used to cover qualified medical expenses, including doctor visits, prescription medications, and other eligible medical services and treatments.

Eligibility for HSA

To be eligible for an HSA, you must meet certain criteria. First, you must be enrolled in a high-deductible health plan (HDHP). The minimum deductible for an HDHP in 2021 is $1,400 for individuals and $2,800 for families. Additionally, the maximum out-of-pocket expenses for an HDHP in 2021 are $7,000 for individuals and $14,000 for families.

Tax Advantages and Contributions to HSA

Contributions to an HSA are tax-deductible, meaning they reduce your taxable income. The contributions can be made by both the individual and their employer. The funds in the HSA can be invested and grow tax-free, and withdrawals are tax-free if used for qualified medical expenses. HSA funds can also be rolled over from year to year, allowing individuals to build a significant nest egg for future medical expenses.

This image is property of hellofurther.com.

Does HSA Cover Massage Therapy?

HSA-Eligible Massage Therapy

While the IRS does not specifically mention massage therapy as a qualified medical expense, there are situations where massage therapy may be considered eligible for HSA coverage. It primarily depends on the purpose and medical necessity of the massage therapy. If the massage therapy is prescribed by a qualified medical practitioner and is deemed medically necessary for the treatment of a specific medical condition, it may be eligible for HSA coverage.

Massage Therapy for Medical Purposes

If massage therapy is recommended by a qualified medical practitioner, such as a physician or physical therapist, as part of a treatment plan for a specific medical condition, it may be considered eligible for HSA coverage. For example, massage therapy for the treatment of chronic pain, sports injuries, or rehabilitation purposes may be eligible for HSA reimbursement.

Limitations and Restrictions on Using HSA for Massage Therapy

It is important to note that not all massage therapy expenses will qualify for HSA coverage. Massage therapy for general relaxation or spa purposes is typically not eligible for HSA reimbursement. Additionally, the HSA funds cannot be used to cover massages that are not prescribed or deemed medically necessary by a qualified medical practitioner.

How to Use HSA Funds for Massage Therapy

Qualified Medical Practitioner

To use HSA funds for massage therapy, it is essential to have a prescription or recommendation from a qualified medical practitioner. This can be a physician, physical therapist, chiropractor, or other licensed healthcare professionals who can determine the medical necessity of massage therapy for your specific condition.

Prescription and Medical Necessity

The prescription or recommendation should clearly state the medical necessity of massage therapy for the treatment of a specific medical condition. It should include information about the diagnosis, expected outcomes, and treatment duration. This documentation is crucial for HSA reimbursement and should be kept for record-keeping purposes.

Documentation and Receipts

When using HSA funds for massage therapy, it is important to keep detailed documentation and receipts. This includes the prescription or recommendation from the qualified medical practitioner, as well as receipts or invoices from the massage therapy sessions. These documents serve as proof of the medical necessity and can be requested in case of an HSA audit.

This image is property of images.squarespace-cdn.com.

Alternative Options for Coverage

Health Insurance Coverage

If your health insurance policy covers massage therapy, it may be an alternative option for coverage. Some health insurance plans include coverage for complementary and alternative therapies, which may include massage therapy. However, it is important to review your health insurance policy and understand the specific coverage and limitations.

Flexible Spending Accounts (FSA)

If you don’t have an HSA but have a Flexible Spending Account (FSA), you may be able to use FSA funds for massage therapy. FSAs are similar to HSAs in that they allow individuals to set aside pre-tax dollars for qualified medical expenses. However, unlike HSAs, FSAs have a “use it or lose it” rule, meaning any unused funds at the end of the year are forfeited.

Out-of-Pocket Payment

If massage therapy is not covered by your health insurance or eligible for HSA reimbursement, you may choose to pay for it out-of-pocket. Many massage clinics and therapists offer affordable rates for individual sessions or package deals. While it may require paying upfront, out-of-pocket payment gives you the flexibility to choose any massage therapist or clinic you prefer.

Tips and Considerations

Verify HSA Eligibility

Before using HSA funds for massage therapy, it is crucial to verify the eligibility with your HSA provider. They can provide specific guidelines and requirements for HSA reimbursement. It is also recommended to keep yourself updated on any changes or updates to IRS regulations regarding qualified medical expenses.

Research Your Health Insurance Policy

If you have health insurance coverage, it is important to review your policy and understand the coverage for massage therapy. Some policies may have specific limitations or requirements for massage therapy coverage. Knowing the coverage details can help you make informed decisions and avoid surprises when it comes to reimbursement.

Consult with Your HSA Provider

If you have any questions or concerns regarding HSA coverage for massage therapy, it is advisable to consult with your HSA provider. They can provide guidance on eligible expenses, documentation requirements, and the reimbursement process. Seeking clarification from experts can ensure compliance with IRS regulations and prevent any potential issues in the future.

This image is property of www.usatoday.com.

Common Misconceptions about Using HSA for Massage

Massage as a Personal Expense

One common misconception is that massage therapy should be considered a personal expense rather than a qualified medical expense. While massage therapy for general relaxation or spa purposes may indeed be considered a personal expense, medically necessary massage therapy prescribed by a qualified medical practitioner can be eligible for HSA reimbursement.

IRS Audits and Compliance

Some individuals worry about potential IRS audits and compliance issues when using HSA funds for massage therapy. To mitigate these concerns, it is crucial to follow the guidelines provided by the IRS and maintain proper documentation and receipts. By having a prescription or recommendation from a qualified medical practitioner and keeping a record of the sessions, you can demonstrate the medical necessity and legitimacy of your expenses if ever audited.

Changing Regulations and Eligibility

Regulations regarding qualified medical expenses and HSA eligibility can change over time. It is important to stay informed about any updates or changes to IRS guidelines and consult with your HSA provider to ensure compliance. By keeping up with the latest regulations, you can make informed decisions and maximize the benefits of your HSA.

Conclusion

In summary, the use of HSA funds for massage therapy depends on the medical necessity and prescription from a qualified medical practitioner. Massage therapy for the treatment of specific medical conditions, when prescribed and deemed medically necessary, may be eligible for HSA reimbursement. It is important to maintain proper documentation and receipts, consult with your HSA provider, and stay informed about any changes to IRS guidelines. By following these guidelines and taking necessary precautions, you can make the most of your HSA and potentially cover the cost of massage therapy through tax-free withdrawals. Remember, proper documentation and compliance are key to using HSA funds for massage therapy.

This image is property of www.zeel.com.